company tax rate 2018 malaysia

Rate TaxRM 0-2500. If the first chargeable income of an SME is RM500000 such a company is charged at a rate of 18.

The rate on about 100 of the largest companies has been 25 per cent since 2018 when the former government increased it to pay.

. For year of assessment 2022 only a special one-off tax will be imposed on companies excluding companies which enjoy the 17 reduced tax rate above which have. A corporate tax rate of 17 to. Not only are the rates 2 lower for those who has a.

Tax rates for companies residing in Malaysia A company is considered as tax resident in Malaysia if its management and control are exercised in Malaysia. Resident company with paid-up capital above RM25 million at the beginning of the basis period 24. Corporate income tax or corporate tax is a direct tax that is paid to the government via IRBMLHDN it is governed under the Income Tax Act 1967.

For the assessment year 2016-2017 it stood at 19 the corporate tax rate in 2018 dropped to 18 in Malaysia and the government has announced a further reduction to 17 for. Rate the standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie. Companies incorporated in malaysia with paid-up capital of myr 25 million or.

Audit tax accountancy in johor bahru comparing tax rates across. Resident companies with a paid up capital of MYR 25 million and below as defined at the beginning of the basis period for a Year of Assessment YA are. Tax Rate Table 2018 Malaysia.

For Year of Assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50. Malaysia Corporate Tax Rate was 24 in 2022.

On the First 10000 Next 10000. Income tax how to calculate bonus and personal tax archives updates. On subsequent chargeable income 24.

Malaysia was ranked 12 out of 190 countries for ease of. It is Necessary to Be Aware of the Malaysia Corporate Tax Rate 2019 Because It is a Factor in the Success of Your Business. New principal hub companies will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 for a period of five years with a possible.

Tax Rate Corporate tax rates for companies resident in Malaysia is 24. Masuzi December 15 2018 Uncategorized Leave a comment 1 Views. On the First 5000 Next 5000.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a. Masuzi December 14 2018 Uncategorized Leave a comment 0 Views. Company Tax Rate 2018 Malaysia Table.

On the First 2500. In case the income exceeds beyond this limit of chargeable income it is charged at a rate. Income tax rates.

The Penang Institute in its 2019 proposal for carbon tax in. Non-resident company branch 24. Resident company with paid-up.

The corporate tax rate is 25. The corporate tax rate in Malaysia is collected from. In the calendar year 2018 the tax rate for medium sized business in Malaysia was 196 percent of commercial profits.

For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups.

Antigua And Barbuda Sales Tax Rate Vat 2022 Data 2023 Forecast

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

United Arab Emirates Corporate Tax Rate 2022 Data 2023 Forecast

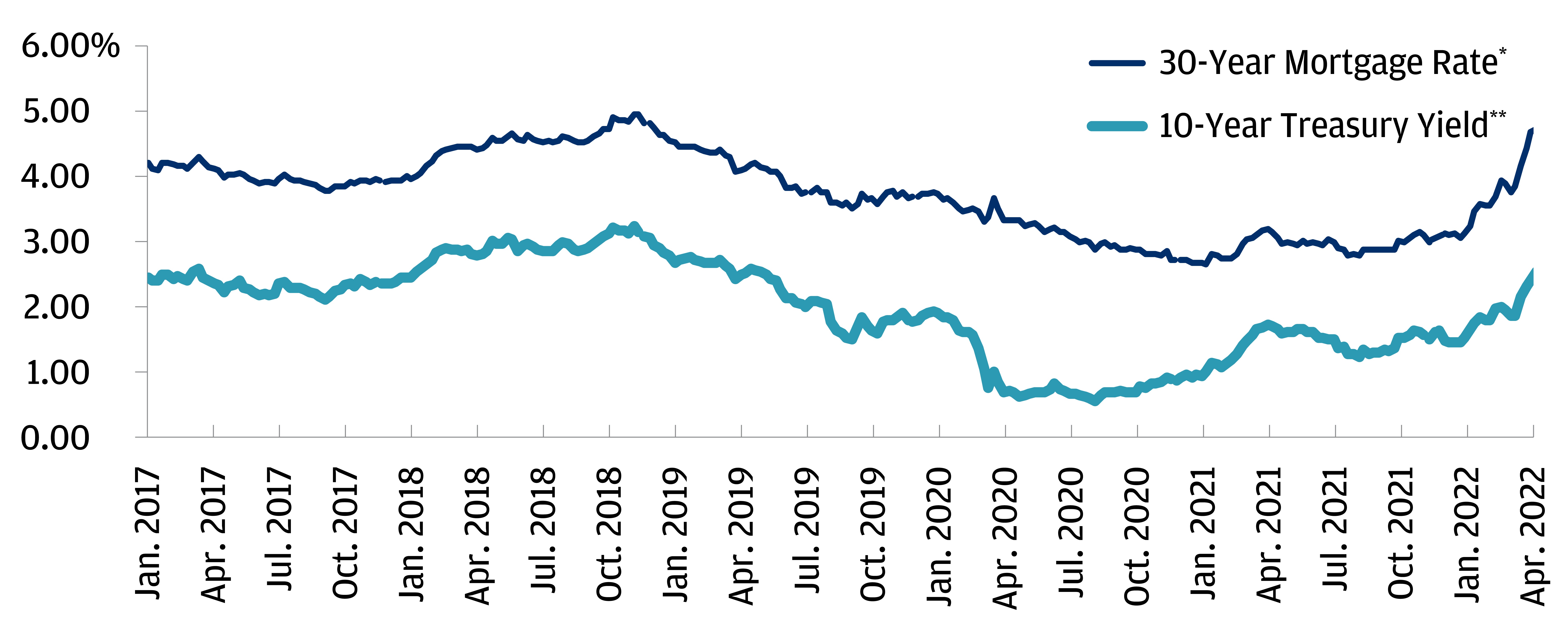

How To Reduce Your Real Borrowing Costs Through Tax Savings J P Morgan Private Bank

Statutory Due Dates For Company Annual Filing For Financial Year 2018 19

How To Calculate Foreigner S Income Tax In China China Admissions

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

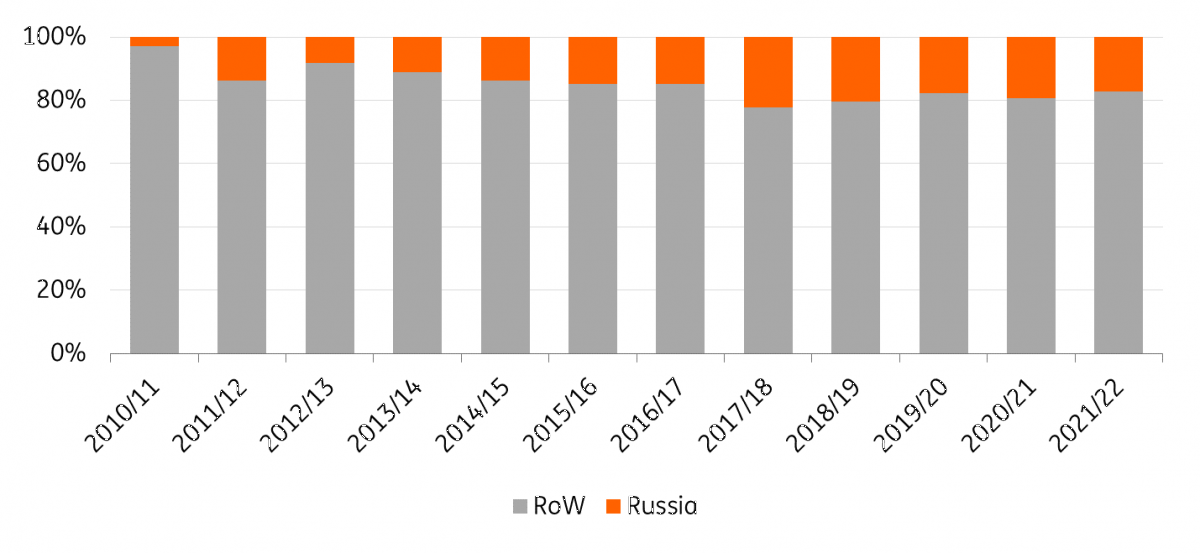

Commodity Prices Could Soar If The Russia Ukraine Crisis Escalates Article Ing Think

New 2022 Irs Standard Mileage Rates

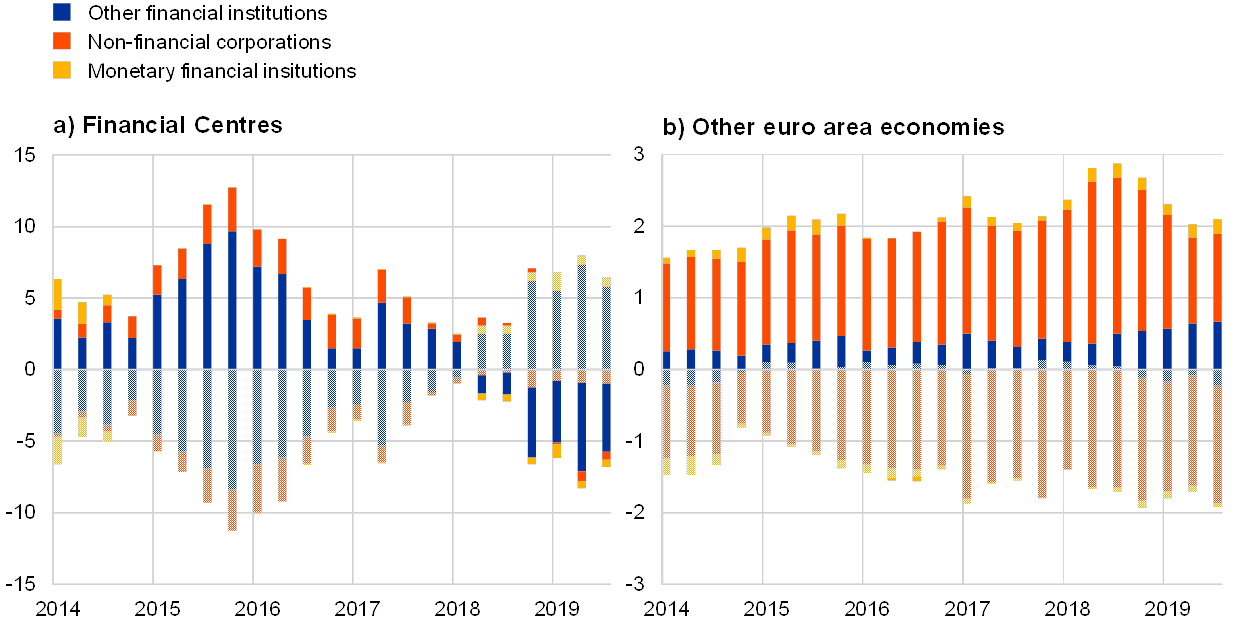

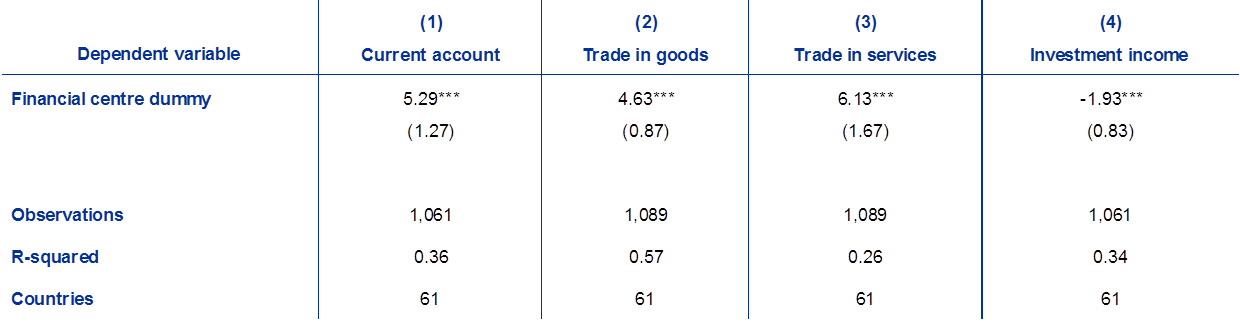

Multinational Enterprises Financial Centres And Their Implications For External Imbalances A Euro Area Perspective

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Malaysia Tax Revenue 1980 2022 Ceic Data

Japan Consumer Price Index Cpi Statista

Multinational Enterprises Financial Centres And Their Implications For External Imbalances A Euro Area Perspective

0 Response to "company tax rate 2018 malaysia"

Post a Comment